MetaTrader 4 vs. MetaTrader 5 vs. cTrader: A Comprehensive Comparison for Forex Traders

When it comes to forex trading platforms, traders often face the dilemma of choosing between the most popular options available in the market: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers unique features, tools, and functionalities, making it important for traders to understand their differences before deciding which one best suits their trading needs.

In this article, we will compare MetaTrader 4, MetaTrader 5, and cTrader based on key factors such as ease of use, features, performance, customization, and market access to help you make an informed decision.

Overview of the Platforms

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most widely used trading platforms in the world, especially among forex traders. Released by MetaQuotes Software in 2005, MT4 revolutionized retail trading by offering a user-friendly interface, advanced charting tools, and automation features. Despite being released years ago, MT4 remains a top choice for many traders due to its simplicity, reliability, and extensive community support.

MetaTrader 5 (MT5)

MetaTrader 5, the successor to MT4, was launched in 2010, offering significant improvements in terms of functionality and versatility. MT5 is a multi-asset platform, supporting not only forex trading but also stocks, commodities, futures, and other financial instruments. It incorporates more advanced features, including improved charting, faster execution, and additional order types.

cTrader

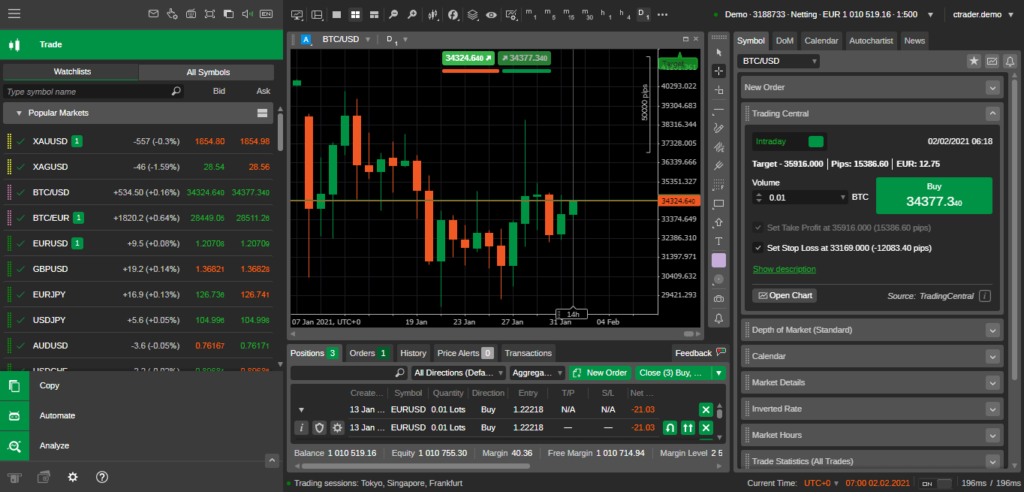

cTrader, developed by Spotware Systems, is a newer platform compared to MT4 and MT5 but has quickly gained popularity among traders for its modern interface and unique features. cTrader focuses on providing a smooth trading experience with fast execution speeds, advanced charting tools, and an easy-to-navigate layout. cTrader is often praised for its clean design and innovative features that appeal to both beginner and advanced traders.

Key Comparison Factors

1. Ease of Use

• MT4: MetaTrader 4 is well-known for its simple and intuitive interface, making it easy for beginners to get started. It offers a straightforward layout with access to all essential trading tools, including charting, indicators, and a built-in market watch. Traders new to forex often find MT4 easy to learn and navigate.

• MT5: While MT5 offers a more modern and advanced interface, it can be slightly overwhelming for beginners. The addition of more features, such as additional timeframes and instruments, might take time to master. However, once familiarized, MT5 provides a comprehensive trading experience.

• cTrader: cTrader boasts a clean, user-friendly interface designed to provide a pleasant trading experience. The platform is optimized for both beginners and experienced traders, with customizable charts and easy access to essential tools. Its drag-and-drop interface and seamless design make it a popular choice for those who value simplicity and functionality.

2. Charting and Technical Analysis

• MT4: MT4 offers a solid set of charting tools, including 9 timeframes, over 30 built-in technical indicators, and a variety of drawing tools. While it may not have as many advanced features as MT5 or cTrader, its simplicity and reliability make it a staple in the forex community.

• MT5: MetaTrader 5 comes with enhanced charting capabilities, providing more timeframes (21) and over 80 built-in indicators. It also includes more advanced charting features, such as additional order types, economic calendars, and a depth of market (DOM) view, which is not available in MT4.

• cTrader: cTrader provides advanced charting features with a highly customizable interface. It includes a wide range of timeframes, technical indicators, and drawing tools. The platform also offers features like multi-chart view, Level II pricing, and advanced order management tools, making it a powerful choice for technical analysis.

3. Order Execution and Speed

• MT4: MT4 is known for its stability and reliability, providing quick order execution. However, it may not be as fast as cTrader or MT5 in terms of speed and slippage, especially during volatile market conditions.

• MT5: MT5 offers faster order execution and improved trade processing compared to MT4. It also includes more advanced features for order management, such as market depth and a broader range of execution modes (e.g., instant, market execution, and pending orders).

• cTrader: cTrader is recognized for its superior execution speed, boasting faster processing times and tighter spreads. Its one-click trading and low-latency execution are highly valued by scalpers and high-frequency traders who rely on speed to gain an edge in the market.

4. Customizability and Automation

• MT4: MT4 offers extensive customizability with a built-in scripting language called MQL4, which allows traders to develop their own indicators, trading robots (Expert Advisors), and scripts. The platform has a massive community with thousands of free and paid indicators and EAs available.

• MT5: MetaTrader 5 features MQL5, an upgraded version of the programming language, which offers more advanced capabilities for algorithmic trading. MT5 has a more robust trading robot market, as well as custom indicators and strategies. However, the learning curve is steeper compared to MT4.

• cTrader: cTrader features cAlgo, a similar automation tool to MetaTrader’s EAs, allowing traders to build automated trading strategies using C# programming. While it may not have as large a marketplace as MT4 or MT5, cTrader’s automation tools are user-friendly and offer advanced capabilities for algorithmic traders.

5. Market Access

• MT4: MT4 is primarily focused on forex trading, making it the platform of choice for currency traders. However, it also supports limited access to CFDs, commodities, and indices.

• MT5: MetaTrader 5 is a multi-asset platform, supporting not only forex but also stocks, commodities, futures, and indices. This makes MT5 a more versatile choice for traders looking to diversify their portfolios across different asset classes.

• cTrader: cTrader supports a wide range of instruments, including forex, commodities, indices, and cryptocurrencies. It is increasingly popular among brokers offering access to both forex and CFDs.

Pros and Cons: MetaTrader 4 vs. MetaTrader 5 vs. cTrader

| Feature | MT4 | MT5 | cTrader |

|---|---|---|---|

| Ease of Use | Simple, beginner-friendly | More complex but powerful | Clean, modern interface |

| Charting | Basic, solid charting tools | Advanced charting features | Highly customizable, great for analysis |

| Order Execution Speed | Reliable, but slower than MT5/cTrader | Faster, advanced execution | Extremely fast, low latency |

| Automation | MQL4 for EAs, huge community | MQL5 for advanced EAs, better capabilities | cAlgo with C#, good automation tools |

| Market Access | Primarily forex | Multi-asset (forex, stocks, futures, etc.) | Forex, CFDs, commodities, crypto |

| Customization | Highly customizable | More complex customization | Customizable, intuitive design |

| Community Support | Large community, extensive resources | Growing community, more features | Smaller but active community |

Conclusion: Which Platform is Right for You?

• MetaTrader 4: Best suited for beginner traders or those who want a straightforward, reliable platform focused on forex trading. MT4 remains a top choice for traders who prioritize simplicity and a massive range of free tools and indicators.

• MetaTrader 5: Ideal for advanced traders who need a versatile platform that supports multiple asset classes, faster execution, and advanced features. If you want to trade not only forex but also stocks, commodities, and futures, MT5 is the way to go.

• cTrader: Perfect for scalpers and high-frequency traders who need fast execution, low latency, and modern features. If you value a clean interface, advanced charting tools, and automation capabilities, cTrader might be your preferred platform.

Ultimately, the best platform depends on your trading style, goals, and level of experience. Each of these platforms has its own strengths, and by understanding their unique features, you can choose the one that aligns with your trading needs.