Trading Strategy Principles

It is a must that every trader should develop their own trading strategy. Without such strategy you will never know when to open and close a trade. What is more, it will be extremely difficult for you to analyse your mistakes and follow the progress of your trading in order to control all the associated risks. Although, there are many different trading strategies out there, they all fall into two main types: Trend Strategy and Consolidation Strategy.

Generally, once you decide to trade there is no need of creating your own trading strategy. In the beginning most traders are testing the strategies that can be found in various websites and forums online. That is one of the important stages of becoming a trader – testing other people’s strategies. Some traders continue to trade on other people’s strategies and only slightly modifying them, while others prefer to create their own.

In any case, it is crucial for you to know what your trading strategy should include and what criteria it must meet. Using a trading strategy helps to structure the trade and removes the emotional stress associated with trading (as we all know trading can be at times very emotional). Even if you close a trade using a stop loss, then it was according to the strategy you are using, you will not experience such an emotional discomfort. You know that sometimes it happens to have losing trades, but if you are following a specific strategy and doing everything as your initial plan was then the emotional discomfort will be different and much less.

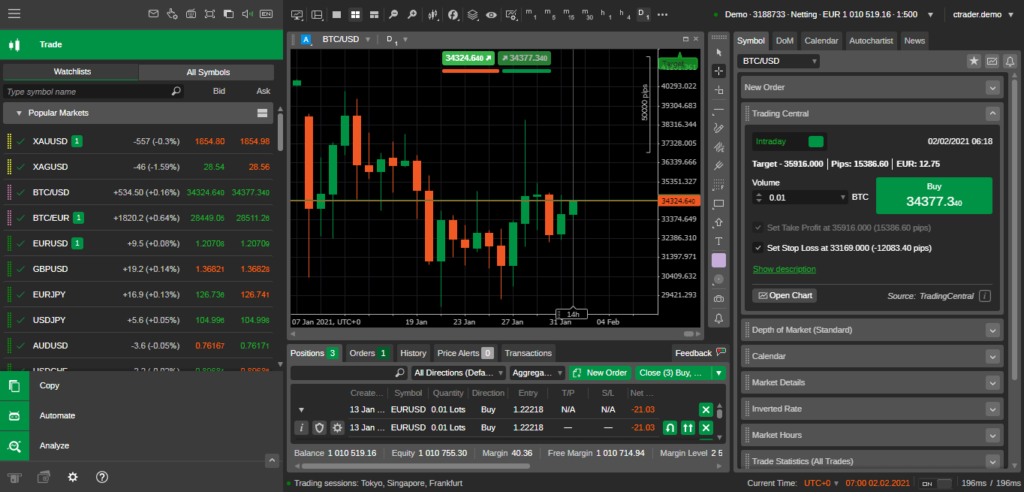

How can you create your own trading strategy and what it should include? First, you need to determine the time frame (interval) of the chart you are most comfortable with. Some traders prefer opening many trades and closing them quickly (scalping) – they need to use short time intervals for their charts. Other traders prefer opening only few trades for longer period and as such they will need wider time frames. This is entirely your decision however keep in mind that the shorted the time interval the more difficult would be to forecast the particular financial instrument.

Furthermore, you should define the currency pair which you will work with (it is not a good idea to start with many different pairs at the same time). Furthermore, it is necessary to determine your entry and exit price for your trade. Always, make sure that your winning trades will be more than the losing ones. Although this is sometimes out of our control, we can adjust the stop loss and take profit values in such way that the profit from a winning trade is always bigger than the loss of a losing trade.

Finally, an important question is the size of the position. This however is directly related to the money management and capital control skills of the individual trader. All in all, you should determine the following parameters in order to create your own strategy: Time frame of the chart, Trading pair, Entry levels, Exit levels, Size of trade.