Stochastic Oscillator Strategy: A Simple Guide for Traders

When it comes to technical indicators in trading, the Stochastic Oscillator remains one of the most reliable tools for identifying potential market reversals and improving entry and exit timing. Whether you’re trading Forex, stocks, or crypto, understanding how to use this momentum indicator can level up your trading strategy—especially in 2025’s fast-moving markets.

In this article, you’ll learn what the Stochastic Oscillator is, how it works, and how to build a profitable trading strategy around it.

📊 What Is the Stochastic Oscillator?

The Stochastic Oscillator is a momentum-based indicator developed by George Lane. It compares a security’s closing price to its price range over a selected period—usually 14 periods.

It consists of two lines:

• %K Line: The current value of the oscillator

• %D Line: A 3-period moving average of %K

The scale ranges from 0 to 100, and it’s used to identify overbought (above 80) and oversold (below 20) market conditions.

⚙️ How the Stochastic Oscillator Works

The idea is simple: When momentum begins to slow down in an uptrend, it’s often a sign of a reversal. Similarly, when momentum slows during a downtrend, it could signal a bounce or new trend.

• Above 80: The market is considered overbought—potential for a price drop

• Below 20: The market is considered oversold—potential for a price rise

• Crossovers between %K and %D can indicate trend shifts

📈 Stochastic Oscillator Trading Strategy

Here’s a basic but powerful Stochastic Oscillator strategy for Forex or any other liquid market:

✅ Entry Rules (Buy Setup):

1. Wait for %K to cross above %D below the 20 level (oversold zone)

2. Confirm with price action (e.g., bullish candle pattern or support zone)

3. Enter a long position

4. Place stop-loss below recent swing low

5. Target the next resistance level or a 1:2 risk/reward ratio

❌ Entry Rules (Sell Setup):

1. Wait for %K to cross below %D above the 80 level (overbought zone)

2. Confirm with bearish candle or resistance area

3. Enter a short position

4. Place stop-loss above recent swing high

5. Target the next support zone

🔄 Stochastic + Trend Filter Combo Strategy

To improve accuracy, many traders combine the Stochastic Oscillator with a trend indicator, such as the 200 EMA.

Example:

• Only take buy signals when the price is above the 200 EMA

• Only take sell signals when the price is below the 200 EMA

This filters out trades that go against the main trend and reduces false signals.

🧠 Pro Tips for Using the Stochastic Strategy

• Don’t rely on overbought/oversold alone. Prices can stay in these zones for extended periods.

• Combine it with support/resistance or chart patterns for better precision.

• Avoid trading during major news events—stochastic signals can get distorted by volatility.

• Use it best on higher timeframes (H1, H4, Daily) for more reliable signals.

📉 Stochastic Oscillator Settings

Default settings:

• %K = 14

• %D = 3

• Smoothing = 3

However, you can adjust these depending on your trading style:

• Short-term traders (scalping/intraday): Try 5,3,3

• Swing traders: Stick to 14,3,3 or 21,9,9

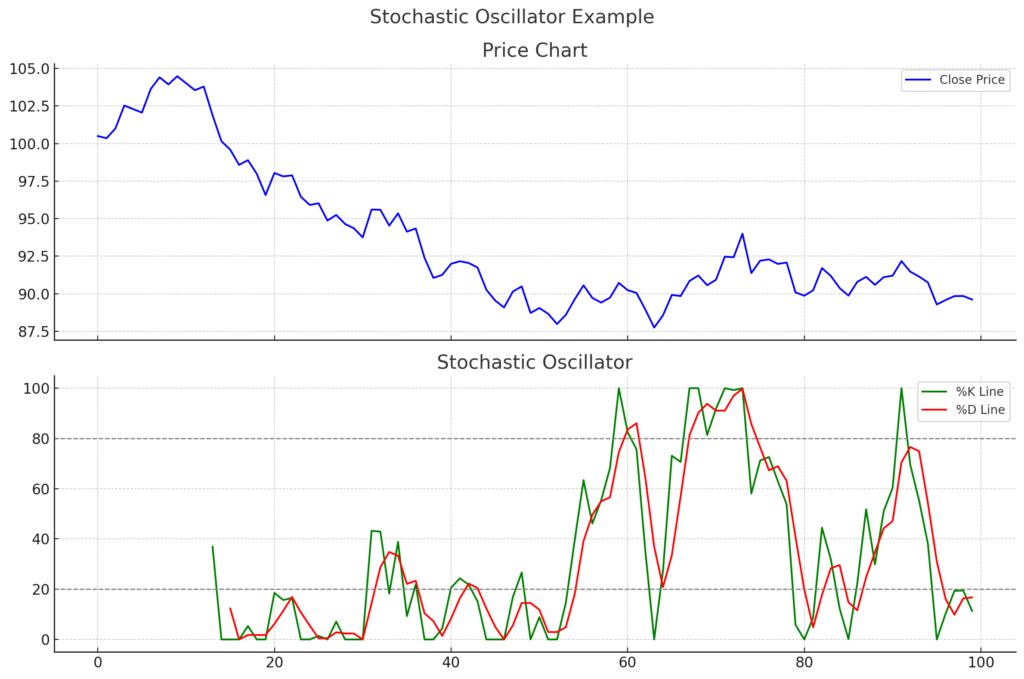

Here’s a visual example of the Stochastic Oscillator in action:

• The top chart shows the price movement (blue line).

• The bottom chart displays the %K line (green) and %D line (red).

• The dashed lines at 80 and 20 represent the overbought and oversold levels.

You can see how the oscillator reacts to price momentum and gives early reversal signals when the %K line crosses the %D line, especially near those key levels.

🚀 Final Thoughts

The Stochastic Oscillator strategy is a time-tested and versatile tool that works well in both range-bound and trending markets—when used correctly. By combining it with other confirmations like trend direction, support/resistance, or candlestick patterns, you can turn this simple indicator into a profitable trading system in 2025 and beyond.

🔗 Want help applying strategies like this in real-time markets?

Join our Smart Forex Pips VIP Channel for premium signals, trading tips, and support: