The Importance of the Risk-Reward Ratio in Forex Trading

In the world of forex trading, where volatility is the norm and the market operates 24 hours a day, having a clear and effective strategy is crucial to success. One of the most important concepts that every trader should understand is the risk-reward ratio. It’s a simple yet powerful tool that helps traders make informed decisions, manage risks, and optimize their trading performance.

In this article, we will explore why the risk-reward ratio is essential for forex traders, how to calculate it, and how it can help you become a more disciplined and profitable trader.

What is the Risk-Reward Ratio?

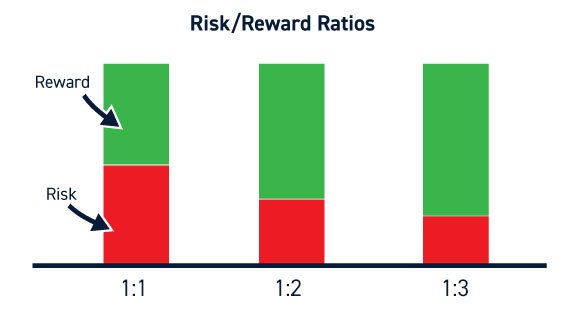

The risk-reward ratio (often abbreviated as RRR) is a measure used by traders to compare the potential profit of a trade to the potential loss. It is the relationship between the amount of risk a trader is willing to take on a trade and the potential reward or profit they aim to achieve.

The formula for calculating the risk-reward ratio is:

Risk-Reward Ratio = Potential Loss / Potential Profit

For example, if you are willing to risk 50 pips on a trade to potentially gain 150 pips, your risk-reward ratio is 1:3. This means for every 1 pip of risk, you are aiming to make 3 pips in profit.

Why is the Risk-Reward Ratio Important?

1. Helps Control Risk Exposure

Managing risk is one of the most crucial aspects of successful forex trading. By using the risk-reward ratio, traders can control their risk exposure for each trade. A good risk-reward ratio helps ensure that traders are not risking more than they are likely to gain, even when faced with losing trades.

For instance, if a trader consistently risks more than they expect to gain, it can lead to significant losses over time. But if the potential reward outweighs the potential loss, the trader can still profit even with a lower win rate.

2. Improves Decision-Making

When you’re focused solely on the reward, you might overlook important aspects of risk. However, by using the risk-reward ratio, you can objectively assess whether a trade is worth taking. A trade with an unfavorable risk-reward ratio (e.g., risking 100 pips to make 50 pips) may not be worth pursuing, while a positive ratio (e.g., risking 50 pips to make 150 pips) can offer greater potential for success.

Having a consistent risk-reward ratio helps you stay disciplined and objective when making trading decisions, reducing impulsive or emotional trading.

3. Aids in Setting Realistic Profit Targets

One of the most important components of a successful trading strategy is defining realistic profit targets. The risk-reward ratio can help you set appropriate take-profit levels based on the amount of risk you are willing to take. By setting achievable goals, you can avoid the temptation to chase unrealistic profits, which can lead to emotional trading and unnecessary risks.

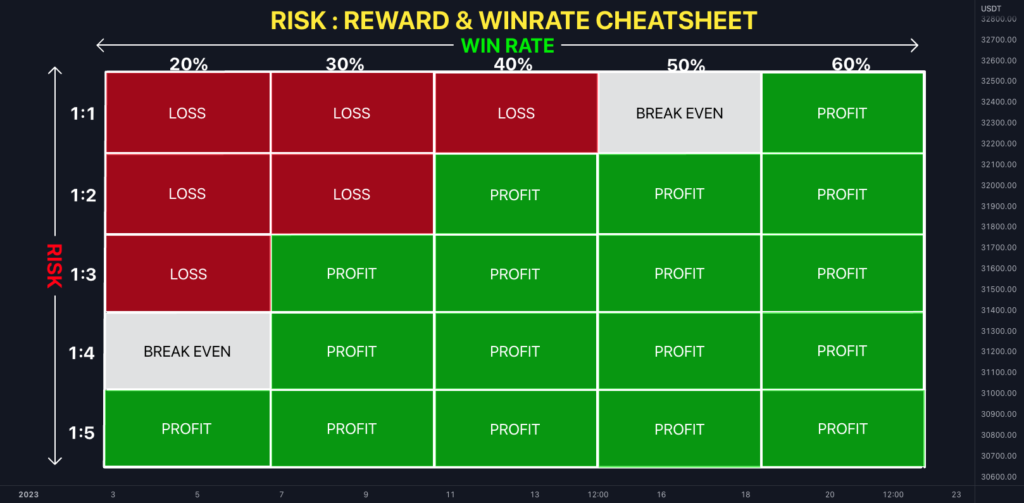

4. Maximizes Profit Over Time

Even with a lower win rate, traders can still be highly profitable if they maintain a favorable risk-reward ratio. For example, a trader who wins 50% of the time with a risk-reward ratio of 1:2 will still be profitable in the long run. In contrast, a trader with a 1:1 ratio would need to win more than 50% of the time to break even.

The key takeaway is that small consistent profits with a good risk-reward ratio can lead to significant overall gains, even with fewer winning trades.

How to Use the Risk-Reward Ratio Effectively

1. Define Your Stop Loss and Take Profit Levels

Before entering any trade, always define your stop loss (SL) and take profit (TP) levels. Your stop loss should be based on a level where you are willing to exit the trade if the market moves against you, while your take profit should be based on a level that reflects your desired reward.

2. Consider Market Conditions

While the risk-reward ratio is a useful tool, it’s important to consider market conditions. In highly volatile markets, you might want to adjust your risk-reward ratio to account for larger price swings. In a trending market, you could look for trades with higher potential rewards.

3. Use a Consistent Ratio

Develop a consistent trading plan with a predefined risk-reward ratio. A common ratio used by many traders is 1:2, meaning that for every 1 unit of risk, the trader aims to make 2 units of profit. This is a good starting point, but the ratio can be adjusted based on your risk tolerance and trading style.

4. Evaluate Your Trading Performance

Review your trades regularly to evaluate your performance. Are you achieving the expected risk-reward ratio in your trades? Are you consistently hitting your stop-loss or take-profit targets? Use your findings to refine your strategy and improve your results.

The Bottom Line: Consistency is Key

The risk-reward ratio is not just a calculation—it’s a mindset. It encourages traders to be disciplined, strategic, and patient, ensuring that the potential rewards outweigh the risks involved. By consistently applying the risk-reward ratio to your trades, you can improve your decision-making, manage your risk effectively, and increase your chances of long-term profitability in the forex market.

Remember, trading is a marathon, not a sprint. By mastering the use of risk-reward ratios and managing your trades with discipline, you can achieve success in the forex market over time.